101 common technical, fit, behavioral, and logic investment banking interview assessments with sample answers

Mr. Arora is an experienced private equity investment professional, with experience working across multiple markets. Rohan has a focus in particular on consumer and business services transactions and operational growth. Rohan has also worked at Evercore, where he also spent time in private equity advisory.

Rohan holds a BA (Hons., Scholar) in Economics and Management from Oxford University.

Reviewed By: Patrick Curtis

Prior to becoming our CEO & Founder at Wall Street Oasis, Patrick spent three years as a Private Equity Associate for Tailwind Capital in New York and two years as an Investment Banking Analyst at Rothschild.

Patrick has an MBA in Entrepreneurial Management from The Wharton School and a BA in Economics from Williams College.

Last Updated: July 17, 2024 In This ArticleThe Investment Banking (IB) interview process is highly competitive and designed to rigorously filter out potential candidates. Consequently, answering the behavioral, technical, and logical questions that are asked in the interview with proven answers that we provide is key to converting an interview into an offer.

The following free WSO IB interview guide is a comprehensive tool designed to cover every single aspect of the interview process, guiding you from the very beginning to the very end.

Before we begin, we wanted to make sure you know about WSO Academy, a program that guarantees you are job in high finance (including investment banking).

The most comprehensive curriculum and support network to break into high finance.

Learn More

We’ve all heard about it at one point or another. Forbes has written on it.

“First impressions are the best impressions.”

Within just a few seconds of meeting, people will form a solid opinion of who you are. Perfecting your first impression while carrying yourself with a healthy balance of confidence and humility lays the foundation and tone for the rest of the interview. The following section has been written by Patrick Curtis, CEO of WallStreetOasis, based on his vast experience of interviewing candidates for investment banking positions.

Read it over, perfect your entry and learn how to leave a lasting impression on your interviewer from the get-go.

There are no excuses for not perfecting what is in your control. Irrespective of the bank, the position, or your region, you can be sure these 2 questions will be asked as they’re a standard in the industry.

Anticipating both of these questions beforehand, crafting a compelling narrative around them, and selling yourself on it will make you stand out from amongst the pool of potential candidates.

Dial-in a cohesive 90-second resume walkthrough that focuses on the positive and motivating factors behind every transition (school to job, job to better job, most recent job to grad school).

A good example:

I went to school to learn how to design cars, but after my first internship I realized that I like interacting with clients directly and pursued full-time roles in B2B sales. In these sales roles, I developed solid selling skills as well as gained exposure to a, b, and c. Since I wanted to continue honing those skills and branch out to focus on x, y, and z, I am seeking a new role/promotion which provides that opportunity…

Be deliberate. Every move you made should have a reason (preferably that you initiated). Don't be negative. Never say you left because you were bored or "wanted to try something new."

The answer to this question should be tailored uniquely to you and to the firm you are interviewing with. While answering this question, it is key to capitalize on your previous professional/leadership experience, highlight it and create a logical path as to why you are now trying to break into investment banking. A good answer to this question is addressing the three main reasons, illustrated below with an example each:

Given the variety of professional backgrounds that candidates come from, WSO has created a dedicated page to answer this question.

WSO’s “Why investment banking?” article covers 43 sample answers, tailored for students and professionals from backgrounds ranging from law to consulting.

The most comprehensive curriculum and support network to break into high finance.

Learn MoreTechnical questions are a critical component of almost every investment banking recruiting process. You WILL be asked these questions, and your interviewers will expect detailed and accurate responses. The following section features 30 of the most common IB interview questions, with a detailed sample answer for each of them.

At the end of these 30 questions, we also have provided you with 14 exclusive bank-specific technical questions (from 7 bulge bracket banks) to kickstart your mock interview training.

Sample Answer:

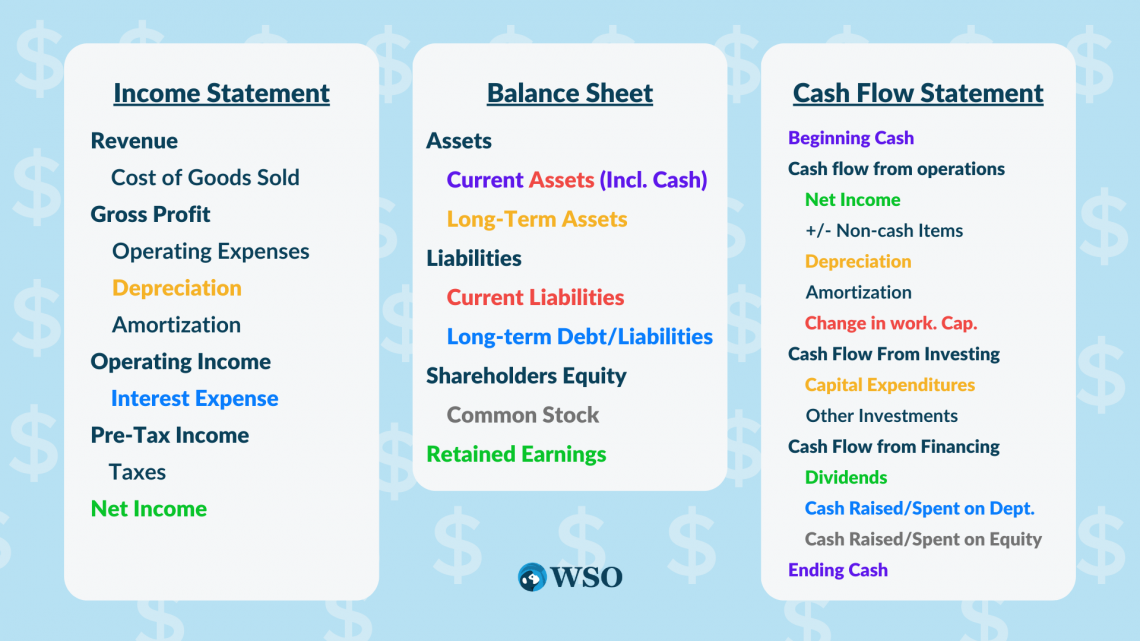

The three main financial statements are

The Income Statement discloses a company's revenues and expenses, which together yield net income over a period of time. The Balance Sheet discloses a company's assets, liabilities, and equity on a specific date. The Cash Flow Statement starts with net income from the Income Statement; then adjusts for non-cash expenses, non-operating expenses like capital expenditures, changes in working capital, or debt repayment and issuance, to arrive at the company's closing cash balance.

Sample Answer:

Net income flows from Income Statement into the Cash Flow Statement (CFS) as Cash Flow from Operations. Net income less dividends are added to retained earnings from the prior period's Balance Sheet (BS) to come up with retained earnings as on the date of the current period's BS. The opening cash balance on the CFS is from the prior period's Balance Sheet while the closing cash balance on the CFS is the balance on the current period's Balance Sheet.”

The following chart gives you a more comprehensive overview of how the 3 financial statements are connected to help visualize and present better for your interview:

Sample Answer:

The cash flow statement because it shows the actual liquidity of the company and how it is generating and using cash. The balance sheet just shows a snapshot of the company at a point in time, without showing the performance of the company, and the Income statement has several non-cash expenses that may not be affecting the company's health and can be manipulated. Overall, the key to a great company is generating significant cash flow and having a healthy cash balance, both of which are disclosed in the CF statement.

Sample Answer:

In the income statement, the depreciation increase of $10 is set off by a reduction of $4 on taxes as depreciation is a tax-deductible expense for the net reduction in net income of $6. In the cash flow statement, net income is reduced by $6, depreciation is increased by $10, net cash from operations and total cash is increased by $4. This increase in cash is because depreciation is a non-cash expense that has no impact on cash while the reduction in taxes affects the cash flow. In the balance sheet, property, plant, and equipment balances reduce by $10, cash balance increases by $4, and retained earnings reduce by $6 due to the reduction in net income.

The following points summarize this:

On the income statement

Reduction in net income flows to cash from operations

Ending cash flows onto th e balance sheet

Sample Answer:

The first line of the Income Statement represents revenues or sales. From that, we subtract the cost of goods sold, which gives gross margin. Subtracting operating expenses from gross margin gives us operating income (EBIT). We then (add/subtract) interest expense (income), taxes, and other expenses (income) to arrive at Net Income.

Sample Answer:

Enterprise Value (EV) is the value of an entire firm, both debt, and equity. This is the price that would be paid for the company in the event of acquisition without a premium.

EV = Market Value of Equity + Debt + Preferred Stock + minority interest - Cash

Sample Answer:

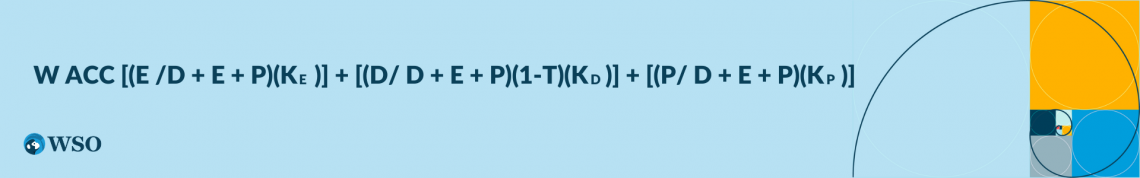

WACC is the acronym for Weighted Average Cost of Capital. It reflects the overall cost for a company to raise new capital, which is also a representation of the riskiness of investment in the company (higher the risk, higher the cost of capital). It is commonly used as the discount rate in a discounted cash flow analysis to calculate the present value of a company's cash flows and terminal value.

The formula below helps you calculate the WACC of a company if you are put on the spot and asked to calculate it as part of your technical interview:

where,

E = Market value of equity

D = Book value of debt

P = Value of preferred stock

KE= Cost of equity (Calculate using CAPM)

KD = Cost of debt (Current yield of debt)

KP = Cost of preferred stock (Interested rate on preferred stock)

T = Corporate tax rate

Sample Answer:

EBITDA stands for Earnings before Interest, Taxes, Depreciation, and Amortization.

It gives us a good idea of a company's profitability and is a quick metric for free cash flow because it will allow you to determine how much cash is available from operations to pay interest, CAPEX, etc.

EBITDA = Revenue - Expense (except depreciation and amortization)

It is also often used for rough valuations in a comparable company or precedent transaction analysis as part of the EV/EBITDA multiple.

Sample Answer:

EBITDA and free cash flow represent cash flows that are available to repay holders of a company’s debt and equity, so a multiple based on one of those two metrics would describe the value of the whole business from the perspective of all its investors.

A multiple such as the P/E ratio, based on earnings alone, represents the amount available to common shareholders after all expenses are paid, using which you would be calculating the value of the firm’s equity.

Book equity value is the accounting value of equity derived by subtracting the value of a company's liabilities from its total assets. It is the total shareholder’s equity, an amount shown as “Total Equity” in the Balance Sheet of the company.

Sample Answer:

Yes. If there are large cash dividends or if the company has been operating at a loss for a long time.

A firm (usually a PE firm) uses a high amount of debt (70 - 90%) to finance the purchase of a company, then uses the company's cash flows to pay off that debt over time.

The acquired company’s assets may be used as collateral. Ideally, the original debt of the acquired company would have been partially retired at the time of exit.

In the context of a private equity investment, the debt acts as a way to magnify returns (boost IRR for the fund), but it can also backfire if the acquisition turns south.

Sample Answer:

There are many reasons why a company would want to issue equity instead of debt. Some of them are:

Sample Answer:

This is possible if working capital erodes (such as increasing accounts receivable, lowering accounts payable, lower inventory turnover) or the company is growing so fast that it’s unable to raise enough capital to fund operations. Another possibility is the existence of financial fraud.

Sample Answer:

The three most common ways of valuing a company are: Comparable companies or multiples analysis: This is the most common way to value a company. This method attempts to find a group of companies that are comparable to the target company and to work out a valuation based on what they are worth. The idea is to look for companies in the same sector and with similar financial statistics (Price to Earnings, Book Value, Free Cash Flow, EBITDA, etc) and then assume that the companies should be priced relatively similarly.

Market valuation or market capitalization: In this method, the market value of equity is used and hence can only be used for publicly traded companies. It is calculated by multiplying the number of shares outstanding by the current stock price.

Discounted cash flow analysis: This method involves calculating the sum of the present values of all future cash flows to give the value of the entire company including debt and equity, which is also called enterprise value.

Here is a list of the four valuation methodologies organized from highest valuation to lowest valuation:

Sample Answer:

Each method of valuation will generate a different value because it is based on different assumptions, different multiples, or different comparable companies and/or transactions. Generally, the precedent transaction methodology and discounted cash flow method lead to higher valuations than comparable companies' analysis or market valuation does.

The precedent transaction result may be higher because the approach usually will include a “control premium” above the company’s market value to entice shareholders to sell and will account for the “synergies” that are expected from the merger.

In an interview, it is important to keep your technical overview at a high level. Start with a high-level overview and be ready to provide more detail upon request.

Common questions that follow this are:

Sample Answer:

You do this because interest expense (the cost of debt) is tax-deductible so you need to account for the benefit provided by this "debt tax shield."

Sample Answer:

The cost of equity is usually calculated using the Capital Asset Pricing Model (CAPM).

CAPM = Risk-free rate + Beta * (Expected market return - Risk-free rate)

Sample Answer:

Find an industry average multiple and multiply it by final year revenue (if using EV/Revenue) or final year EBITDA (if using EV/EBITDA).

Sample Answer 1:

An IPO is the first public sale of stock in a previously private company. This is known as “going public.” The IPO process is incredibly complex, and investment banks charge high fees to lead companies through it. Companies go public for several reasons—raising capital, cashing out for the original owners, and investor and employee compensation.

Some negatives against “going public” include sharing future profits with public investors, loss of confidentiality, loss of control, IPO fees to investment banks, and legal liabilities.

Sample Answer:

Accounts receivable is revenue, which has been earned and recognized because the product has been delivered, but the customer has not yet paid the cash. Deferred revenue is cash that has been collected for products that have not yet been delivered, so the revenue has not yet been recognized. Accounts receivable is an asset on the Balance Sheet, whereas deferred revenue is a liability.

Sample Answer:

You should use the market value of equity always because the book value is not adjusted once it is recorded in the books at the time of issue of the shares. It is common to very often see a share priced in the hundreds or thousands having a face value of $1 or $10. This is due to the historical nature of accounting. Hence, the book value of equity is useless for any kind of valuation, and market value is the preferred metric to use.

Enterprise Value = Equity Value + Net Debt + Preferred Stock + Minority Interest.

Sample Answer:

If we assume there is no minority interest or preferred stock, then Net Debt will be $80mm – $40mm, or $40mm.

Sample Answer:

Cash-based accounting recognizes sales and expenses when cash flows in and out of the company.

Accrual-based accounting recognizes revenues and expenses as they are incurred regardless of whether cash flows in or out of the company at that exact time.

Accrual-based accounting is the more common method for large corporations.

Sample Answer:

Major factors that justify mergers and acquisitions are:

Sample Answer 1:

Normally, the larger company will be considered “safer” and therefore will have a lower WACC all else being equal. However, depending upon their respective capital structures, the larger company could also have a higher WACC.

Sample Answer 2:

Without knowing more information about the companies, it is impossible to say. If the capital structures are the same, then the larger company should be less risky and therefore have a lower WACC. However, if the larger company has a lot of high-interest debt, it could have a higher WACC.

Sample Answer:

Beta is a measure of the volatility of an investment compared with the market as a whole. The market has a beta of 1, and hence, investments that are more volatile than the market have a beta greater than 1 while those that are less volatile have a beta less than 1.

Sample Answer:

Unlevering beta allows us to remove the effect of debt in the capital structure. This shows us the beta of the firm's equity had it not used any leverage in its capital structure. Also, if we are trying to do a market comparison with a company that's not on the market (so no beta), you can take a comparable company and unlever its beta and use this unlevered beta as a proxy for the unlisted company's beta.

Net Working Capital = Current Assets – Current Liabilities

Current assets include items on the Balance Sheet like inventory, accounts receivable, prepaid expenses, and other short-term assets. Current liabilities include items such as accounts payable, accrued expenses, deferred revenue, and other short-term liabilities.

An increase in net working capital means more cash is tied up in the operations. This could be from increasing current assets like inventory or accounts receivable. If you increase inventory, for example, it is not (yet) a cost on the Income Statement, but still blocks the cash that was used for purchasing the inventory which needs to be accounted for on the CF statement. This is why in calculating free cash flow you subtract an increase in net working capital.

A decrease in net working capital means less cash is tied up in operations. This could happen due to changes such as increasing accounts payable or reducing inventory. If you reduce inventory, it means you are selling more goods than you are producing, which means you are realizing a cost on your Income Statement. If you are increasing accounts payable, you are preserving your liquidity by taking a little bit longer to pay your vendors for your raw materials/inputs.

Sample Answer:

Net Working Capital is calculated as current assets minus current liabilities. It is a measure of a company’s ability to pay off its short-term liabilities with its short-term assets. A positive number means they can cover their short-term liabilities with their short-term assets. A negative number indicates that the company may have trouble paying off its creditors, which could result in bankruptcy if cash reserves are insufficient and further financing cannot be arranged.

Intuitively, you can think of working capital as the net dollars tied up to run the business. As more cash is tied up (either in accounts receivable, inventory, etc.), free cash flow will be reduced.

Remember that if the assets go up in value (denoting a purchase of assets), this is a use of cash; and if a liability goes up (denoting funds received), it is a source of cash.

Sample Answer:

You subtract the change in Net Working Capital when you calculate Free Cash Flow, so if Net Working Capital increases, your Free Cash Flow decreases and vice versa.

Sample Answer:

There are many ways a company can raise its stock price, a few of which are:

Sample Answer:

Fortune 500 companies are usually in the mature stage of their business lifecycle. This means they have stable growth accompanied by a good amount of stable cash flows and balances. As a CFO of one, I would look out for signs of declining products or services to be discontinued while also actively keeping an eye out for opportunities to expand and grow, either through mergers and acquisitions or by increasing the spending on internal research and development.

Walk me through every calculation you are doing. I want to hear you think out loud.

I sometimes just ask for a simple calculation, along with "Are you sure?" to put on a little pressure and see how you respond.

Don't be afraid to say, "I don't know" to a tough technical question.